Prepared Food Sales Tax . Effective august 29, 2024, sales of food and food. Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Web prepared food and beverage tax returns are changing. Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Web sales of prepared food are subject to tax. Effective with the august 2024 prepared. Web in accordance with 2022 house bill 2106, starting january 1, 2023, the state sales and use tax rate on food and food ingredients,. Food sold in a heated state. Out of 45 states that impose some sales tax, 13 impose. Prepared food means any of the following: Web oklahoma sales and use tax guide for prepared food and food ingredients. Food sold in a heated state or heated by.

from www.formsbank.com

Web in accordance with 2022 house bill 2106, starting january 1, 2023, the state sales and use tax rate on food and food ingredients,. Web prepared food and beverage tax returns are changing. Food sold in a heated state. Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Prepared food means any of the following: Effective august 29, 2024, sales of food and food. Web sales of prepared food are subject to tax. Web oklahoma sales and use tax guide for prepared food and food ingredients. Effective with the august 2024 prepared. Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal.

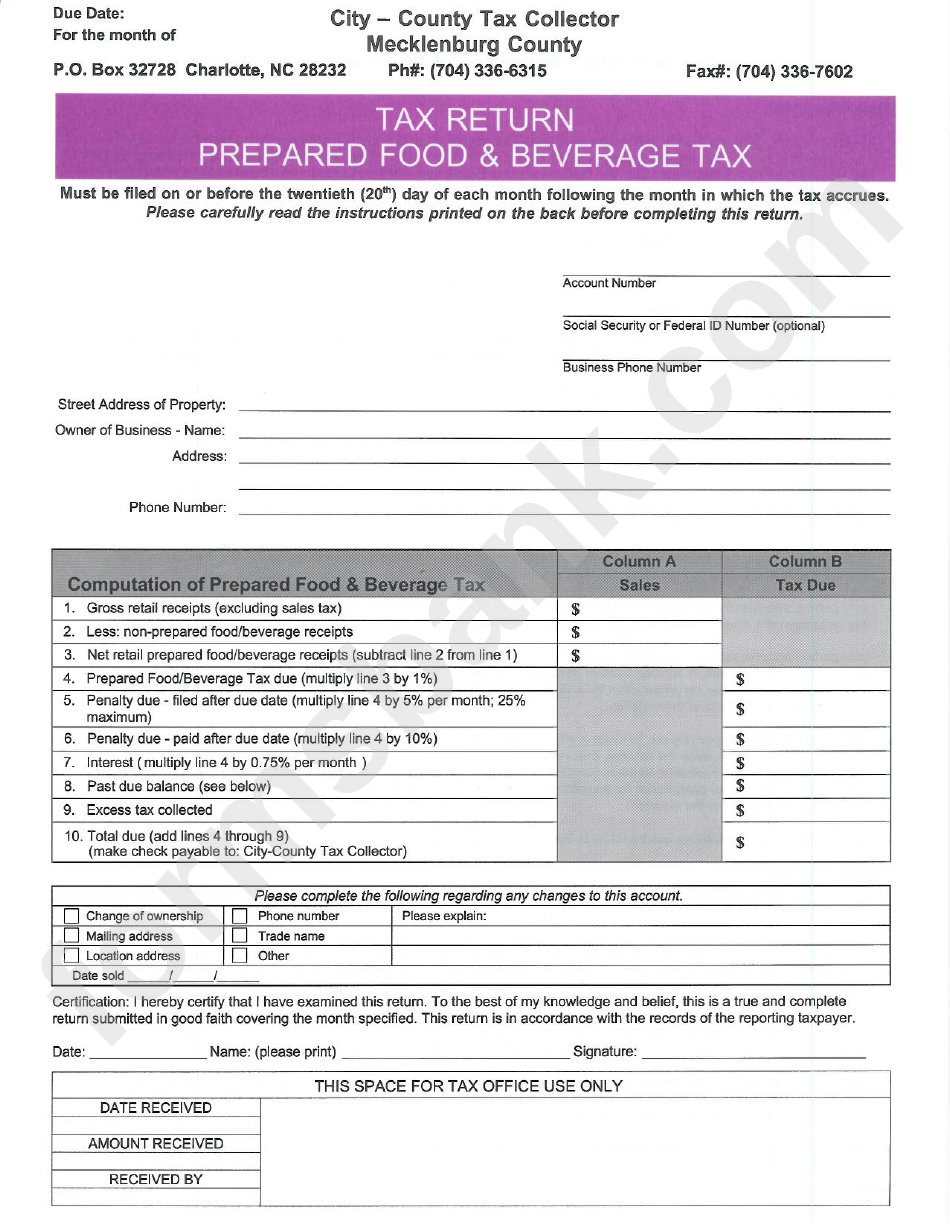

Tax Return Prepared Food & Beverage Tax Form Mecklenburg County

Prepared Food Sales Tax Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Effective august 29, 2024, sales of food and food. Prepared food means any of the following: Web in accordance with 2022 house bill 2106, starting january 1, 2023, the state sales and use tax rate on food and food ingredients,. Web oklahoma sales and use tax guide for prepared food and food ingredients. Out of 45 states that impose some sales tax, 13 impose. Web prepared food and beverage tax returns are changing. Web sales of prepared food are subject to tax. Food sold in a heated state. Food sold in a heated state or heated by. Effective with the august 2024 prepared.

From www.iolaregister.com

Axe the food sales tax now The Iola Register Prepared Food Sales Tax Out of 45 states that impose some sales tax, 13 impose. Effective august 29, 2024, sales of food and food. Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Effective with the august 2024 prepared. Web in accordance with 2022 house bill 2106, starting. Prepared Food Sales Tax.

From www.slideserve.com

PPT SALES TAX GUIDELINES FOR SCHOOL DISTRICTS PowerPoint Presentation Prepared Food Sales Tax Prepared food means any of the following: Out of 45 states that impose some sales tax, 13 impose. Web prepared food and beverage tax returns are changing. Web sales of prepared food are subject to tax. Effective with the august 2024 prepared. Food sold in a heated state. Web states also charge sales tax for prepared food in restaurants and. Prepared Food Sales Tax.

From www.formsbank.com

Prepared Food & Beverage Tax James City County, Virginia printable Prepared Food Sales Tax Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Effective with the august 2024 prepared. Web oklahoma sales and use tax guide for prepared food and food ingredients. Web in accordance with 2022 house bill 2106, starting january 1, 2023, the state sales and. Prepared Food Sales Tax.

From www.formsbank.com

Tax Return Prepared Food & Beverage Tax Form Mecklenburg County Prepared Food Sales Tax Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Food sold in a heated state. Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Food sold in a heated state or heated by. Web. Prepared Food Sales Tax.

From www.ksn.com

Kansas customers experience extra charges after new food sales tax Prepared Food Sales Tax Effective august 29, 2024, sales of food and food. Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Effective with the august 2024 prepared. Web. Prepared Food Sales Tax.

From www.formsbank.com

Prepared Food And Beverage Tax Return Form City Of Salem printable Prepared Food Sales Tax Food sold in a heated state. Food sold in a heated state or heated by. Web oklahoma sales and use tax guide for prepared food and food ingredients. Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Web sales of prepared food are subject to tax. Out of 45 states. Prepared Food Sales Tax.

From www.cbpp.org

Which States Tax the Sale of Food for Home Consumption in 2017 Prepared Food Sales Tax Food sold in a heated state or heated by. Out of 45 states that impose some sales tax, 13 impose. Effective with the august 2024 prepared. Web sales of prepared food are subject to tax. Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Web meals taxes generally apply to. Prepared Food Sales Tax.

From www.wattagnet.com

Fresh prepared food sales Chicken is well positioned Prepared Food Sales Tax Effective august 29, 2024, sales of food and food. Web sales of prepared food are subject to tax. Web in accordance with 2022 house bill 2106, starting january 1, 2023, the state sales and use tax rate on food and food ingredients,. Prepared food means any of the following: Food sold in a heated state. Web states also charge sales. Prepared Food Sales Tax.

From www.templateroller.com

Download Instructions for Form STMAB4 Sales Tax on Meals, Prepared Prepared Food Sales Tax Web sales of prepared food are subject to tax. Food sold in a heated state. Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Effective august 29, 2024, sales of food and food. Prepared food means any of the following: Web prepared food and. Prepared Food Sales Tax.

From empowermissouri.org

It's Time to Eliminate Sales Tax on Groceries Empower Missouri Prepared Food Sales Tax Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Web oklahoma sales and use tax guide for prepared food and food ingredients. Effective august 29, 2024, sales of food and food. Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment,. Prepared Food Sales Tax.

From www.formsbank.com

Fillable Meals Tax Return Form printable pdf download Prepared Food Sales Tax Food sold in a heated state. Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Web prepared food and beverage tax returns are changing. Food sold in a heated state or heated by. Effective august 29, 2024, sales of food and food. Out of. Prepared Food Sales Tax.

From www.cbpp.org

Sales Tax Rates on Food Purchases Vary Significantly Center on Budget Prepared Food Sales Tax Web sales of prepared food are subject to tax. Effective with the august 2024 prepared. Web oklahoma sales and use tax guide for prepared food and food ingredients. Prepared food means any of the following: Out of 45 states that impose some sales tax, 13 impose. Web in accordance with 2022 house bill 2106, starting january 1, 2023, the state. Prepared Food Sales Tax.

From www.uslegalforms.com

NC Tax Return Prepared Food & Beverage Tax 2013 Fill out Tax Template Prepared Food Sales Tax Web prepared food and beverage tax returns are changing. Web oklahoma sales and use tax guide for prepared food and food ingredients. Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Effective august 29, 2024, sales of food and food. Web meals taxes generally apply to purchases of prepared food. Prepared Food Sales Tax.

From www.formsbank.com

Fillable Form StMab4 Sales Tax On Meals, Prepared Food And All Prepared Food Sales Tax Web sales of prepared food are subject to tax. Food sold in a heated state or heated by. Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go”. Prepared Food Sales Tax.

From www.cbpp.org

States That Still Impose Sales Taxes on Groceries Should Consider Prepared Food Sales Tax Web in accordance with 2022 house bill 2106, starting january 1, 2023, the state sales and use tax rate on food and food ingredients,. Effective august 29, 2024, sales of food and food. Effective with the august 2024 prepared. Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Prepared food. Prepared Food Sales Tax.

From www.templateroller.com

Download Instructions for Form STMAB4 Sales Tax on Meals, Prepared Prepared Food Sales Tax Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Effective with the august 2024 prepared. Web oklahoma sales and use tax guide for prepared food and food ingredients. Food sold in a heated state. Web states also charge sales tax for prepared food in. Prepared Food Sales Tax.

From www.castiron.me

Cottage Food Sales Tax Understanding the Basics Castiron Prepared Food Sales Tax Web in accordance with 2022 house bill 2106, starting january 1, 2023, the state sales and use tax rate on food and food ingredients,. Web prepared food and beverage tax returns are changing. Web meals taxes generally apply to purchases of prepared food that are consumed in a restaurant or similar establishment, or taken “to go” for later. Web states. Prepared Food Sales Tax.

From www.formsbank.com

Prepared Food & Beverage Tax Return Mecklenburg County Office Of The Prepared Food Sales Tax Web states also charge sales tax for prepared food in restaurants and grocery stores as it is a meal. Effective august 29, 2024, sales of food and food. Prepared food means any of the following: Web in accordance with 2022 house bill 2106, starting january 1, 2023, the state sales and use tax rate on food and food ingredients,. Food. Prepared Food Sales Tax.